Archive

China Approves Kuwaiti Refinery

BEIJING—China has given final approval to Kuwait to build an oil refinery in the south of the country in a joint venture with China Petroleum & Chemical Corp., a person with firsthand knowledge of the decision said Tuesday.

BEIJING—China has given final approval to Kuwait to build an oil refinery in the south of the country in a joint venture with China Petroleum & Chemical Corp., a person with firsthand knowledge of the decision said Tuesday.

China, dependent on oil imports, has been making deals with major producers to process more crude domestically.

The $9 billion project between Kuwait Petroleum Corp. and Asia’s largest refiner by capacity, also known as Sinopec, has been under negotiation for more than five years. It includes a refinery with a capacity of 300,000 barrels a day in the city of Zhanjiang in Guangdong province and an ethylene plant with a capacity of a million tons a year, along with related utilities, jetties and oil pipelines, according to previous comments from government and company officials involved in the Read more…

Current US Gas Prices around the lower 48 States

If You Think This Oil Spike Is Temporary, Check Out This Chart

So beyond the Middle East instability trend, there’s a much bigger problem lurking.

Middle East Meltdown Could Mean Oil at $300 a Barrel, Pump Prices of $9.57 a Gallon

moneymorning.com [Editor’s Note: U.S. oil prices yesterday (Tuesday) hit their highest levels since September 2008 as investors reacted to fears that Middle East tumult would spread from Libya to such key Organization of Petroleum Exporting Countries (OPEC) as Iran and Saudi Arabia. But never fear: Even if the Middle East melts down and oil prices soar, there are moves you can make to hedge away your risk. We have two suggestions for you here.] By Martin Hutchinson, Contributing Editor, Money Morning The unrest in the Middle East oil patch is roiling the global oil markets on an almost daily basis.  The events in Egypt, Libya, Saudi Arabia, Oman and other countries are also forcing us to ask that long-dreaded question: What happens if the countries throughout the Middle East region fall to radical governments? The answer is both stunning and surprising. In an absolute worst-case scenario – if the entire Middle East falls under radical control – we could be looking at $300-a-barrel oil and pump prices of $9.57 a gallon. Definitely a stunner. Here’s the surprise: Even such a worst-case outcome would Read more…

The events in Egypt, Libya, Saudi Arabia, Oman and other countries are also forcing us to ask that long-dreaded question: What happens if the countries throughout the Middle East region fall to radical governments? The answer is both stunning and surprising. In an absolute worst-case scenario – if the entire Middle East falls under radical control – we could be looking at $300-a-barrel oil and pump prices of $9.57 a gallon. Definitely a stunner. Here’s the surprise: Even such a worst-case outcome would Read more…

Kuwait is the Spear Pointing at the Heart of Saudi Arabia

Despite the reassurances and promises of change and trinkets for the masses, the front page news continues to reflect that Bahrain is the most dangerous situation for the Kingdom of Saudi Arabia. The reasoning is that the Shi’a will spread their unrest into the Eastern Provinces along the rich oil producing regions of the nation and interrupt the flow of oil operations and embolden the Iranian regime to create mischief against their historic foe. In my opinion, this is a reach as the spear pointing towards the heart of the Kingdom is in Kuwait, a nation which has escaped the mainstream media’s attention up until this point in time.

Despite the reassurances and promises of change and trinkets for the masses, the front page news continues to reflect that Bahrain is the most dangerous situation for the Kingdom of Saudi Arabia. The reasoning is that the Shi’a will spread their unrest into the Eastern Provinces along the rich oil producing regions of the nation and interrupt the flow of oil operations and embolden the Iranian regime to create mischief against their historic foe. In my opinion, this is a reach as the spear pointing towards the heart of the Kingdom is in Kuwait, a nation which has escaped the mainstream media’s attention up until this point in time.

The reason Bahrain is so key can best be summed up by the United States military interests in the region based there. Unfortunately for the media, the true story is the same one people realized in 1990 when Iraq invaded Kuwait. Kuwait is the key to destroying the stranglehold the Saudi royal family has held on the Persian Gulf and the revolutionary movements of the region have understood this for twenty years now. When the Iraqi regime was crushed by the U.S. this decade the focus shifted from expelling the various monarchies in the Gulf region to using terror to expel the American “occupiers” as our nation was so labeled. When the strategy of state sponsored and funded terrorism failed, the revolutionaries and Read more…

Will $200 oil kill the economy?

Unrest in key oil-producing nations opens the door to price spikes that could push gas to $7 a gallon and spin the world back into recession. Here’s how we’d get there, and how to protect your portfolio.

Are your pocketbook and portfolio ready for $200-a-barrel oil?

This kind of dramatic price spike may seem less likely now than a few days ago, with oil markets calming down a bit and the price slipping below $100. But given the instability and unrest rolling through the Middle East and North Africa, it’s a definitely a viable scenario.

For the moment, most oil sector analysts have gone off high alert because of a Saudi Arabian pledge to increase production to make up for any shortfalls sparked by unrest. But that ignores a key angle in all this: There’s simply not enough spare capacity to make up for the production losses we’d see if the rolling crises in the region hit just two or three major producers at once.

This could easily happen, given the heightened Read more…

Bernanke warns on oil price ‘threat’

WASHINGTON (AFP) – Federal Reserve chairman Ben Bernanke on Tuesday warned a “sustained” rise in oil prices could threaten US growth and spark dangerous price rises, as he eyed turmoil in Libya.

Bernanke told Congress he believed unrest in the oil-rich Middle East would result in “temporary” and “modest” increase in US prices, but acknowledged greater risks remain.

“The most likely outcome is that the recent rise in commodity prices will lead to Read more…

Graph of the Amount of Oil Production Affected by Crisis

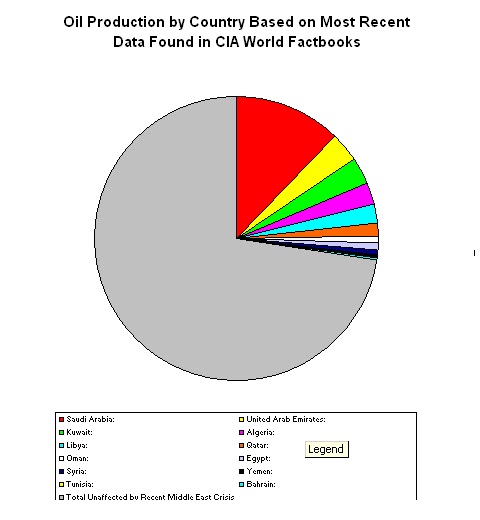

Although Obama might not view what is happening in the Middle East as all that important- he is going to basketball games and concerts and instead directing attempts to riot in WI- I think it is very important because the Middle East region sits on a very important resource- oil. So for fun, I put together a graph this morning to demonstrate the amount of oil production that is affected by the crisis in the Middle East. The graph shows oil production by country based on the most recent data I found in the CIA World Factbook, and shows each nation currently in crisis or about to be in crisis, and then the gray area represents all other nations not currently affected.

Any change in oil production likely will cause the price of gasoline to go up, and as you can see, a large percentage of the world’s oil comes out of this affected region, although if Saudi Arabia stays stable, then the percentages is considerably less although still significant. In my amateur opinion, gas prices are going to rise, the economy will dip again, and Obama will react to this all by supporting our enemies and lowering our oil output. Here is the graph:

Gas Prices Set to Rise Nearly 40 Cents in Coming Days

Kurt Nimmo

Infowars.com

February 24, 2011

Earlier this week, market analysts warned that the price of gas may reach $5 by the end of summer. Now they are saying we could see that price by Memorial Day as the situation in Libya deteriorates.

Earlier this week, market analysts warned that the price of gas may reach $5 by the end of summer. Now they are saying we could see that price by Memorial Day as the situation in Libya deteriorates.

On the S&P 500 today, the price of Brent Crude breached $119 a barrel during a period of frantic trading. Brent Crude is used to price two thirds of the world’s internationally traded crude oil supplies. The price was below $100 yesterday afternoon.

The world’s oil benchmark jumped almost $17 this week and it appears there is no end in sight as the situation in the Middle East heats up.

Saudi Arabia is under pressure to boost output as the prospect of a Libya production cutoff looms.

Oil traders said Saudi talks with Europe signal that the oil kingdom understands that the political crisis in Libya is now an oil supply crisis.

On Thursday, the Italian oil company Eni, the most active company in Libya, said oil production from the North African country has dropped to just a quarter of normal levels.

“You can only expect the price to go up. It is fear of the unknown. The risks are all to the Read more…

If Libyan unrest spreads, gas could reach $5

Gary Strauss on Feb. 21, 2011 USA Today News

If political unrest in Libya spreads to other oil-rich countries and the ensuing chaos disrupts crude oil production, gas prices could hit $5 a gallon by peak summer driving season, industry analysts say.

If political unrest in Libya spreads to other oil-rich countries and the ensuing chaos disrupts crude oil production, gas prices could hit $5 a gallon by peak summer driving season, industry analysts say.

Benchmark crude oil prices soared Monday, rising about 6% to $95.39 a barrel for April contracts on the New York Mercantile Exchange as violence and a military crackdown spread in Libya, the first major oil-producer hit by a burgeoning anti-government movement. The increased violence prompted BP and Norway’s Statoil to pull oil workers from the besieged country.

“If this thing escalates and there’s a good chance that there’d be a shift in supplies, $5 gas isn’t out of the question,” says Darin Newsom, senior analyst at Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.