Archive

Will War With Syria Cause The Price Of Oil To Explode Higher?

Are you ready to pay four, five or possibly even six dollars for a gallon of gasoline? War has consequences, and a conflict with Syria has the potential to escalate wildly out of control very rapidly. The Obama administration is pledging that the upcoming attack on Syria will be “brief and limited” and that the steady flow of oil out of the Middle East will not be interrupted. But what happens if Syria strikes back? What happens if Syrian missiles start raining down on Tel Aviv? What happens if Hezbollah or Iran starts attacking U.S. or Israeli targets? Unless Syria, Hezbollah and Iran all stand down and refuse to fight back, we could very easily be looking at a major Read more…

Are you ready to pay four, five or possibly even six dollars for a gallon of gasoline? War has consequences, and a conflict with Syria has the potential to escalate wildly out of control very rapidly. The Obama administration is pledging that the upcoming attack on Syria will be “brief and limited” and that the steady flow of oil out of the Middle East will not be interrupted. But what happens if Syria strikes back? What happens if Syrian missiles start raining down on Tel Aviv? What happens if Hezbollah or Iran starts attacking U.S. or Israeli targets? Unless Syria, Hezbollah and Iran all stand down and refuse to fight back, we could very easily be looking at a major Read more…

$6 Gas This Summer — U.S. Economy Falls Off Cliff

Dominique de Kevelioc de Bailleul:

Dominique de Kevelioc de Bailleul:

Strap on that safety belt for one wild summer of frantic trading in the energy complex, according to economist, prolific author and wealth strategist, Stephen Leeb. He says gas prices in the US could reach $6 per gallon by the summer driving season.

And if there’s any economic event that could surely torpedo an already near-flat-lined US economy into a death spiral, it will come from a massive price hike in that most critical commodity to any economy—oil. According to the charts, oil has again breached the Read more…

into a death spiral, it will come from a massive price hike in that most critical commodity to any economy—oil. According to the charts, oil has again breached the Read more…

Iran cuts oil exports to France, Britain

The Huffington Post

TEHRAN, Iran — Iran has halted oil shipments to Britain and France, the Oil Ministry said Sunday, in an apparent pre-emptive blow against the European Union after the bloc imposed sanctions on Iran’s crucial fuel exports.

The EU imposed tough sanctions against Iran last month, which included a freeze of the country’s central bank assets and an oil embargo set to begin in July. Iran’s Oil Minister Rostam Qassemi had warned earlier this month that Tehran could cut off oil exports to “hostile” European nations. The 27-nation EU accounts for about 18 percent of Iran’s oil exports.

However, the Iranian action was not likely to have any significant direct impact on European supplies because both Britain and France had already moved last year to sharply curtail Read more…

Strike call as Nigeria doubles fuel price

Nigeria’s main trade unions have called for a nationwide strike and mass demonstrations from Monday to protest over the government’s scrapping of fuel subsidies.

Nigeria’s main trade unions have called for a nationwide strike and mass demonstrations from Monday to protest over the government’s scrapping of fuel subsidies.Petrol prices have more than doubled since Sunday, when the subsidy was withdrawn. Taxi, bus and motorcycle fares shot up similarly, causing widespread anger and sparking two days of small but vocal protests in the major cities.

Cheap petrol – a litre cost 65 naira ($0.41), before January 1 – has for years been one of the only benefits most Nigerians get from the government. The National Labour Congress and Trades Union Congress said on Wednesday that if the subsidy was not reinstated they would launch “indefinite general strikes, mass rallies and street protests”, starting on January 9.

“All offices, oil production centres, air and sea ports, fuel stations, markets, banks, among others will be Read more…

WikiLeaks: Saudis Often Warned U.S. About Oil Speculators

Further evidence of the vacuity of the ‘war for oil’ argument. Much of the price for oil is today determined in the derivatives market by Wall Street speculators rather than by producers or suppliers. The underlying commodity usually has a minimum impact on the actual price. But the Commodity Futures Trading Commission will not investigate this for the same reason why it was prevented from investigating the banks. Because Wall Street owns the executive branch. (Don’t miss the excellent Inside Job and this post by Pat Lang).

Why oil prices will spike again soon

How long till the next oil shock?

Energy prices have been coming down this spring as fears of a Middle East blowup fade. But persistent global demand, tepid supply growth and easy money mean it may not be long till the next damaging spike, Goldman Sachs economists say.

Oil prices could surge again by the end of 2012, economists Jan Hatzius and Andrew Tilton wrote in a note to clients this past weekend. They say the snail-like pace of global oil supply expansion – which Goldman projects at 1% or so annually – can’t keep a petroleum-addicted world economy rolling without prices rising, perhaps sharply.

So don’t get too used to paying a mere $3 and change for gasoline. Higher prices are on the way soon enough, thanks to stretched supplies and a Federal Reserve spigot that is likely to remain wide open for years to come.

“The fundamental story of increased oil scarcity is unchanged, and our commodity strategists now see distinct upside risks to their current forecast of $120/barrel for Brent crude by late 2012,” Hatzius and Tilton write. “So the impact of scarcer oil and higher oil prices on economic activity remains at the top of our list of worries.”

What makes higher oil prices almost inevitable is the depth of the jobs deficit in the United States. Unemployment is officially 9% but is more like 13% if you consider the low rate of labor force participation, says Bernstein Research strategist Vadim Zlotnikov. That number has fallen this year to levels not seen since 1985.

High joblessness and weak inflation will keep the fed funds rate near zero at least through next year and perhaps longer, Hatzius and Tilton write. That should help keep pushing unemployment slowly toward its long-run average of around 6% — but at the expense of further dollar depreciation, stronger global demand and, ultimately, higher oil prices.

So the selloff that has taken the crude price down to $100 or so in New York and $112 in Europe, where Brent is traded, may persist through much of 2011. But it won’t last Read more…

Bank of America sees Brent oil rallying to $140

I posted a article back in December if oil were to go over $145 in 2011. The bad news is in the forthcomming months it will hit $200 per barrel.

LONDON, April 20 (Reuters) – Bank of America Merrill Lynch (BAC.N: Quote) said it expected Brent crude LCOc1 to hit $140 a barrel in the next three months, before falling later in the year as high prices curb demand.

LONDON, April 20 (Reuters) – Bank of America Merrill Lynch (BAC.N: Quote) said it expected Brent crude LCOc1 to hit $140 a barrel in the next three months, before falling later in the year as high prices curb demand.

Brent crude has traded as high as $127.02 in 2011, the highest since 2008 when prices reached an all-time peak above $147.

Influential banks in commodities are expressing contrasting views on whether the rally will persist.

“The time is not yet ripe for oil demand destruction, and we maintain our view that Brent oil will average $122 a barrel this quarter, with prices Read more…

Gas prices surge toward $4, threaten economic recovery

Gas prices continued to gallop toward $4 a gallon early this week, both in the area and across the state, as prices in Minocqua and Rhinelander hit $3.99 on Tuesday, even as prices for crude oil eased, at least temporarily.

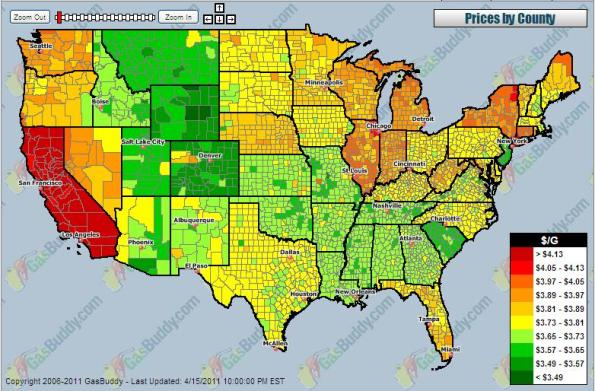

Across the nation, according to GasBuddy.com on Wednesday morning, the national average price for a gallon of regular gasoline stood at $3.79; in Wisconsin, the average was $3.87. Four states, including Illinois, have seen prices already surpass $4.

Crude oil prices moved downward Tuesday from $113 a barrel – the highest price since September 2008 – to $106, a Read more…

Pastor Lindsey Williams: Nwo to Target ‘Yemen’ Next!

Lindsey Williams announced on the Alex Jones Show that the New World Order will be targeting the fall of Yemen next. Saudi Arabia will be last to fall in the Middle East thus causing oil prices to escalate from $150 to $200 per barrel. He also touches on the current devaluation of the US Dollar and the current gold and silver explosion in commodities. If you are able to… listen to this interview and research it for yourself.

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.