Archive

QE2 Is Damaging The Economy And Reducing GDP Growth

QE2 is going to go down as one of the worst monetary policy initiatives in the history of the modern Federal Reserve era. On almost any metric applied, QE2 ends up not only falling well short of its proposed goals, but actually turns certain metrics like GDP growth negative compared with the prior quarter, and heading in the wrong direction.

QE2 is going to go down as one of the worst monetary policy initiatives in the history of the modern Federal Reserve era. On almost any metric applied, QE2 ends up not only falling well short of its proposed goals, but actually turns certain metrics like GDP growth negative compared with the prior quarter, and heading in the wrong direction.

Costs Eat into Corporate Profits = No Hiring

Analysts all over Wall Street are starting to revise their 2nd quarter GDP forecasts down, and some like Goldman Sachs have made several downward revisions as higher input costs due to a weak dollar are creating an additional burden on businesses and consumers and thus slowing economic growth.

A weak dollar (Fig. 1) to a point can help exports, but an extremely weak dollar which in combination with QE2 liquidity juicing up commodities even further, turns out to be a net negative on the economy, and risks sending the Read more…

The Federal Reserve Must Implement QE3

Gold prices surged today to a new all time high of $1,463.70 per ounce, while silver prices soared to a new 31-year high of $39.785 per ounce. Silver is now up 129% since NIA declared silver the best investment for the next decade on December 11th, 2009, at $17.40 per ounce. The gold/silver ratio is now down to 37, compared to a gold/silver ratio of 66 when NIA declared silver the best investment for the next decade. This means that not only is silver up 129% in terms of dollars since December 11th, 2009, but silver has also increased in purchasing power by 1.78X in terms of gold.

Gold prices surged today to a new all time high of $1,463.70 per ounce, while silver prices soared to a new 31-year high of $39.785 per ounce. Silver is now up 129% since NIA declared silver the best investment for the next decade on December 11th, 2009, at $17.40 per ounce. The gold/silver ratio is now down to 37, compared to a gold/silver ratio of 66 when NIA declared silver the best investment for the next decade. This means that not only is silver up 129% in terms of dollars since December 11th, 2009, but silver has also increased in purchasing power by 1.78X in terms of gold.

Gold is the world’s most stable asset and the best gauge of inflation. This brand new breakout in the price of gold leads us to believe that the Federal Reserve is getting ready to unleash QE3 at the end of June. The Fed will surely not call it QE3, but NIA can pretty much guarantee that the Fed will continue on with their purchases of U.S. treasuries. If the Fed pauses after QE2, it will mean that treasury bond yields will need to surge to a level where they attract enough private sector and foreign central bank Read more…

Bernanke warns on oil price ‘threat’

WASHINGTON (AFP) – Federal Reserve chairman Ben Bernanke on Tuesday warned a “sustained” rise in oil prices could threaten US growth and spark dangerous price rises, as he eyed turmoil in Libya.

Bernanke told Congress he believed unrest in the oil-rich Middle East would result in “temporary” and “modest” increase in US prices, but acknowledged greater risks remain.

“The most likely outcome is that the recent rise in commodity prices will lead to Read more…

Dollar Declines to Lowest Since November on Wagers Fed Will Lag Behind ECB

The dollar fell to its lowest level since November against the currencies of six U.S. trade partners on bets the European Central Bank will be more aggressive than the Federal Reserve about controlling inflation.

The dollar fell to its lowest level since November against the currencies of six U.S. trade partners on bets the European Central Bank will be more aggressive than the Federal Reserve about controlling inflation.

The euro rose against the dollar on speculation ECB President Jean-Claude Trichet may indicate this week a readiness to increase borrowing costs while Fed Chairman Ben S. Bernanke may signal economic stimulus will continue. Sweden’s krona climbed to a 30-month high after Riksbank Governor Stefan Ingves said interest rates may be raised at every meeting this year.

“The big driver for the euro has been short-term interest- rate differentials, which had moved against the dollar,” said Paresh Upadhyaya, head of Americas G-10 currency strategy at Bank of America Corp. in New York. “Since the beginning of the year it’s been pretty much a one-way trend.”

IntercontinentalExchange Inc.’s Dollar Index, which tracks the greenback against six currencies, decreased as much as 0.7 percent to 76.756, the lowest level since Nov. 9, before trading at 76.893 at 5 p.m. in New York, down 0.5 percent. The gauge, which is weighted 57.6 percent on euro movements, fell 1.1 percent in February. Read more…

World On Fire – Mapping Last Week’s 88 Global Protests

from ZeroHedge.com

Feeling like the entire world is on the verge of a global revolution? It’s understandable. According to the attached interactive map, based on Google News data, in the past week, there have been 88 reported instances of protest somewhere in the world. How much of this is due to snow, and how much is due to Bernanke’s increasingly more genocidal policies (has anyone done a tally of how many people have died in various riots, protests and revolutions since the beginning of the year – perhaps it is time) is unknown and irrelevant.

Dollar on the Edge of the Abyss

By Toby Connor

The dollar is now poised on the edge of the abyss.

The current intermediate cycle has rolled over and is making lower lows and lower highs. The current daily cycle has formed a swing high and is in jeopardy of rolling over into a left translated cycle. If the dollar breaks below the November intermediate bottom of 75.63 it will be an incredibly bearish sign as not only will the current intermediate cycle have topped in only 4 weeks but the larger yearly cycle will also have topped in only 4 weeks.

If that happens there is little chance the dollar will be able to hold above the March`08 lows as the crash down into the three year cycle low begins in earnest.

US price increases hit consumers

Confirming what most US shoppers already suspected, the Labor Department on Thursday reported prices for everything from vegetables to unleaded fuel rose again in January.

The Labor Department’s consumer price index rose 0.4 percent for the month, a rate that was slightly higher than economists expected and which confirmed large price increases for commonly bought goods in the last year.

The figures showed gasoline prices have leaped over 13 percent in the last 12 months, while grocery prices rose slowly but Read more…

The Fed is Wrong About Commodity Prices

Author: David Weinstein

I imagine he has to say it, but Bernanke is wrong when he says US monetary policy has nothing to do with international commodity prices. At the height of the Egyptian crisis, which was partly driven by rising food prices, Bernanke couldn’t say, “Oh yea, US policy economic policy is part of the problem in Egypt.” This attitude, however, is both prevalent and respected, and it’s largely wrong.

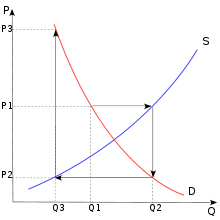

First of all, commodities as a group are not commoditized – they are not all the same. For instance, the amount of gold in the world is largely fixed relative to annual gold production. Along with its historical position as a store a value, Gold’s consistent volume about ground is a primary reason for its currency-like quality; i.e. almost entirely driven by overall liquidity. Corn production, on the other hand can vary greatly from year to year given the amount of land devoted to it and the weather. Oil is somewhere in the middle because production can vary, but the worlds known reserves are relatively fixed. The resulting differences in price volatility have been studied ad nauseam and are most simply articulated by the so-called ‘cob-web model’ (see chart below).

Very simply put: Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.