Archive

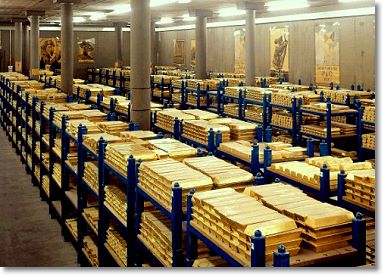

India to pay gold instead of dollars for Iranian oil. Oil and gold markets stunned

India is the first buyer of Iranian oil to agree to pay for its purchases in gold instead of the US dollar, debkafile’s intelligence and Iranian sources report exclusively. Those sources expect China to follow suit. India and China take about one million barrels per day, or 40 percent of Iran’s total exports of 2.5 million bpd. Both are superpowers in terms of gold assets.

By trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its central bank’s assets and the oil embargo which the European Union’s foreign ministers agreed to impose Monday, Jan. 23. The EU currently buys around 20 percent of Iran’s oil exports.

The vast sums involved in these transactions are expected, furthermore, to boost the price of gold and depress the value of the dollar on world markets.

Iran’s second largest customer after China, India purchases around Read more…

Wikileaks Discloses The Reason(s) Behind China’s Shadow Gold Buying Spree

Wondering why gold at $1850 is cheap, or why gold at double that price will also be cheap, or frankly at any price? Because, as the following leaked cable explains, gold is, to China at least, nothing but the opportunity cost of destroying the dollar’s reserve status. Putting that into dollar terms is, therefore, impractical at best, and illogical at worst. We have a suspicion that the following cable from the US embassy in China is about to go not viral but very much global, and prompt all those mutual fund managers who are on the golden sidelines to dip a toe in the 24 karat pool. The only thing that matters from China’s perspective is that “suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the Read more…

Wondering why gold at $1850 is cheap, or why gold at double that price will also be cheap, or frankly at any price? Because, as the following leaked cable explains, gold is, to China at least, nothing but the opportunity cost of destroying the dollar’s reserve status. Putting that into dollar terms is, therefore, impractical at best, and illogical at worst. We have a suspicion that the following cable from the US embassy in China is about to go not viral but very much global, and prompt all those mutual fund managers who are on the golden sidelines to dip a toe in the 24 karat pool. The only thing that matters from China’s perspective is that “suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the Read more…

The Largest Bubble in U.S. History

On August 6th after S&P downgraded the U.S. debt rating from AAA to AA+ with a negative outlook, NIA prayed that Americans would not make the mistake of buying U.S. Treasuries as a safe haven. We normally don’t pray about economic matters, but only God can save the U.S. economy today as well as investors who have been brainwashed into believing U.S. government dollar-denominated bonds are a safe place to store wealth. Unfortunately, only when hyperinflation arrives will the majority of American citizens realize that fiat U.S. dollars should be used as a medium of exchange only and not a place to store wealth.

On August 6th after S&P downgraded the U.S. debt rating from AAA to AA+ with a negative outlook, NIA prayed that Americans would not make the mistake of buying U.S. Treasuries as a safe haven. We normally don’t pray about economic matters, but only God can save the U.S. economy today as well as investors who have been brainwashed into believing U.S. government dollar-denominated bonds are a safe place to store wealth. Unfortunately, only when hyperinflation arrives will the majority of American citizens realize that fiat U.S. dollars should be used as a medium of exchange only and not a place to store wealth.

Since NIA was launched two and a half years ago, the overwhelming majority of our economic predictions have come true, with many of our accurate predictions being unique only to us. Sometimes we are a bit early with our predictions, but they almost always eventually come true. One of our predictions that Read more…

The Central Banks and Gold

If the mantra of the wise investor is “Buy low, sell high,” then those who run most of the Western world’s central banks must suffer from dyslexia.

These banks sold off their gold reserves for years, right into the teeth of a generation-long bear market. The last year before the sales began – i.e., during which central banks were net buyers of gold – was 1988, when the price of the metal fell from $485/oz. in early January to $410 at year’s end.

From then and right through the end of the century, they continued to sell as gold dropped steadily to its modern low of $250. The banks were in such haste to divest themselves of this disrespected relic – their single tangible asset – that it was deemed necessary to Read more…

Peter Schiff says no ceiling for gold prices

Peter Schiff says gold is more than just another precious metal. According to the president of Euro Pacific Capital, gold is a thermometer for the economy. And with gold prices at a high of $1851 an ounce, the economy isn’t getting any healthier.

“Gold going up every day is saying that Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.