Archive

Signals Spain may seek bailout spelling disaster for eurozone

Violent protests against austerity cuts have broken out in Spain, as the country struggles to deal with record-high unemployment signaling that Madrid could possibly be next in line for an EU bailout.

Across the border, Portugal’s crumbling economy is desperate for a €78 billion rescue package. Read more…

IMF Says Europe’s Debt Woes Could Spread

The International Monetary Fund is warning that the governmental debt problems in Greece, Ireland and Portugal could spread to other European countries that employ the euro currency and also to the emerging economies in eastern Europe.

The International Monetary Fund is warning that the governmental debt problems in Greece, Ireland and Portugal could spread to other European countries that employ the euro currency and also to the emerging economies in eastern Europe.

In its semi-annual report on the European economy, the IMF said Thursday that officials so far have been able to contain the continent’s debt contagion to the three countries on Europe’s geographic periphery. But the Washington-based financing agency said there “remains a tangible downside risk” of debt problems spreading. It said European nations will have to make “unrelenting” efforts to contain their financial problems.

The IMF said weak banking systems remain a threat to the financial health of the 17 nations where the euro is the common currency. It said the reduction in the number of banks in Europe is proceeding too slowly and that greater financial integration on the continent is needed.

Greece and Ireland reluctantly accepted bailouts from the IMF and their European neighbors last year and now Portugal is Read more…

Why Is the U.S. Bankrolling IMF’s Bailouts in Europe?

humanevents

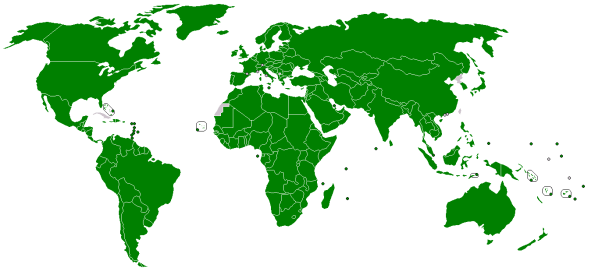

The World Bank and International Monetary Fund held their spring meeting April 14 to 18 in Washington, D.C. Both financial titans were created after World War II to foster economic cooperation and development around the globe. With 16.2% of the International Monetary Fund (IMF) shares, the United States is the largest shareholder among the 187 nations who belong to the fund—even though its managing director has always been a European.

The World Bank and International Monetary Fund held their spring meeting April 14 to 18 in Washington, D.C. Both financial titans were created after World War II to foster economic cooperation and development around the globe. With 16.2% of the International Monetary Fund (IMF) shares, the United States is the largest shareholder among the 187 nations who belong to the fund—even though its managing director has always been a European.

Remote to most Americans, the IMF has been in the headlines recently because of its role as one of the financial rescuers of three European nations whose economies collapsed last year. Under Managing Director Dominique Strauss-Kahn (the former French finance minister, who is considered the leading Socialist candidate for president of France in 2012), the IMF has joined with the European Union to sculpt bailout packages for Greece, Ireland, and Portugal. Coupled with loans from the EU, the price tags on the bailout packages come to $157 billion for Greece, $122 billion for Ireland, and most recently, $116 billion for Portugal.

Obviously, these are quite substantial packages for the three economically devastated countries. They will become very relevant to U.S. taxpayers when they realize that, because we are the largest single contributor to the organization, and with Spain and Italy now Read more…

Setbacks in Portugal and Ireland Renew Worry on Debt Crisis

Allied Irish Bank is one of several prominent financial institutions in Ireland in need of a rescue.

LONDON — A higher-than-expected budget deficit in Portugal and the need for more money to rescue Ireland’s failing banks have renewed fears that Europe’s debt crisis is worsening despite its sizable bailout fund.

Officials in Lisbon said Thursday that the country’s budget deficit last year was 8.6 percent of its gross domestic product, well above the goal of 7.3 percent. Although officials said the revision would not affect the government’s goal of reaching a deficit of 4.6 percent of domestic product in 2011, the news was a reminder that, even after the problems from Greece’s fraudulent deficit statistics, some numbers from the euro zone remain unreliable.

Also Thursday, Ireland’s central bank announced that four of the country’s most prominent financial institutions would need an additional 24 billion euros to cover sour real estate loans, a move that pushes the Read more…

IMF Prepares For “Threat To International Monetary System”

Back in April 2010, before Waddell and Reed sold a few shares of ES, effectively destroying the market on news that Europe was insolvent, we made the following observation: “The IMF has just announced that it is expanding its New Arrangement to Borrow (NAB) multilateral facility from its existing $50 billion by a whopping $500 billion (SDR333.5 billion), to $550 billion.” Little did we know that our conclusion “something big must be coming” would prove spot on just a month later after Greece, then Ireland, then Portgual, and soon Spain, Italy, Belgium, and pretty much all other European countries would topple like dominoes tethered together by a flawed monetary regime. Well, based on news from Dow Jones we can now safely predict the following: “something bigger must be coming.” As if the IMF’s trillions in open lending facilities (many of which have recently been adjusted to uncapped) were not enough, we now learn that the world lender of last resort (which in theory is the Fed, but apparently Bernanke has been getting a little Read more…

Back in April 2010, before Waddell and Reed sold a few shares of ES, effectively destroying the market on news that Europe was insolvent, we made the following observation: “The IMF has just announced that it is expanding its New Arrangement to Borrow (NAB) multilateral facility from its existing $50 billion by a whopping $500 billion (SDR333.5 billion), to $550 billion.” Little did we know that our conclusion “something big must be coming” would prove spot on just a month later after Greece, then Ireland, then Portgual, and soon Spain, Italy, Belgium, and pretty much all other European countries would topple like dominoes tethered together by a flawed monetary regime. Well, based on news from Dow Jones we can now safely predict the following: “something bigger must be coming.” As if the IMF’s trillions in open lending facilities (many of which have recently been adjusted to uncapped) were not enough, we now learn that the world lender of last resort (which in theory is the Fed, but apparently Bernanke has been getting a little Read more…

Portugal’s Government May Collapse Before EU Summit

In a report published by Reuters, the Portuguese parliament is expected to reject government austerity measures on Wednesday, which could lead to the collapse of the minority Socialist administration one day before the EU summit.

In a report published by Reuters, the Portuguese parliament is expected to reject government austerity measures on Wednesday, which could lead to the collapse of the minority Socialist administration one day before the EU summit.

The country’s Prime Minister, Jose Socrates, has declared that he will resign if the plan is defeated, due to the fact that its rejection would force debt-ridden Portugal to seek a similar international bailout to Greece and Ireland.

If Socrates stands by his word, then he appears to be heading for the exit door as all opposition parties have proposed resolutions calling for the rejection of the measures, which would look to cut the debt by reducing pensions and state spending.

The main opposition is the Social Democrats, and the party has already begun talking about a snap election. When asked if it is likely that the government will step down, Socialist bench leader in parliament Francisco Assis said that, “If all these positions that now seem irreversible are confirmed, then yes.”

“The prime minister does not want to resign, but he cannot govern against his convictions,” Assis said.

Pressure on Portugal After New Credit Downgrade

LISBON — Portugal’s borrowing costs pushed higher after Moody’s downgraded the country’s credit rating, stoking the pressure on the country’s beleaguered minority government.

LISBON — Portugal’s borrowing costs pushed higher after Moody’s downgraded the country’s credit rating, stoking the pressure on the country’s beleaguered minority government.

The yield on Portugal’s ten-year bond rose 0.04 percentage point to 7.44 percent. The equivalent yields for Greece and Spain, two other euro countries struggling with high borrowing levels, were down modestly.

Moody’s Investors Services cut the country’s rating by two notches to A3 late Tuesday, saying the debt-stressed country is struggling to generate growth and faces a tough battle to restore the fiscal health needed to calm jittery financial markets.

Prime Minister Jose Socrates said late Tuesday he would quit if Parliament doesn’t consent to his government’s latest batch of contested austerity measures.

Portugal aims to raise up to €1 billion in a sale of Read more…

People Of Earth: Prepare For Economic Disaster

It is not just the United States that is headed for an economic collapse. The truth is that the entire world is heading for a massive economic meltdown and the people of earth need to be warned about the coming economic disaster that is going to sweep the globe. The current world financial system is based on debt, and there are alarming signs that the gigantic global debt bubble is getting ready to burst. In addition, global prices for the key resources that the major economies of the planet depend on are rising very rapidly. Despite all of our advanced technology, the truth is that human civilization simply cannot function without oil and food. But now the price of oil and the price of food are both increasing dramatically. So how is the current global economy supposed to keep functioning properly if it soon costs much more to ship products between continents? How are the billions of people that are just barely surviving today supposed to feed themselves if the price of food goes up another 30 or 40 percent? For decades, most of the major economies around the globe have been able to Read more…

It is not just the United States that is headed for an economic collapse. The truth is that the entire world is heading for a massive economic meltdown and the people of earth need to be warned about the coming economic disaster that is going to sweep the globe. The current world financial system is based on debt, and there are alarming signs that the gigantic global debt bubble is getting ready to burst. In addition, global prices for the key resources that the major economies of the planet depend on are rising very rapidly. Despite all of our advanced technology, the truth is that human civilization simply cannot function without oil and food. But now the price of oil and the price of food are both increasing dramatically. So how is the current global economy supposed to keep functioning properly if it soon costs much more to ship products between continents? How are the billions of people that are just barely surviving today supposed to feed themselves if the price of food goes up another 30 or 40 percent? For decades, most of the major economies around the globe have been able to Read more…

Why the World Must Watch Europe

Beyond the EU Debt Crisis

The continent’s financial crisis gave rise to bailouts, infighting and demands for sweeping financial reform. Could there still be a bright future over the horizon for the European Union?

Amid the shift in global superpowers, two names come up as heavyweight world championship opponents: China and the United States.

The constant media exposure and speculation could be likened to a pay-per-view boxing matchup.

In one corner: the world’s largest energy consumer—with a 1.3-billion-strong population—endlessly stockpiling natural resources—and holding nearly $900 billion in United States’ debt.

In the other: longtime democratic world champion—largest economy—and leader in manufacturing.

China is the clear favorite, but the U.S. is still in the running. On its way down from unmatched superpower, it is still a formidable opponent, with its manufacturing sector out-producing China by 40 percent.

Yet America is weighed down by a $14 trillion federal debt and rampant Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.