Archive

Dollar Declines to Lowest Since November on Wagers Fed Will Lag Behind ECB

The dollar fell to its lowest level since November against the currencies of six U.S. trade partners on bets the European Central Bank will be more aggressive than the Federal Reserve about controlling inflation.

The dollar fell to its lowest level since November against the currencies of six U.S. trade partners on bets the European Central Bank will be more aggressive than the Federal Reserve about controlling inflation.

The euro rose against the dollar on speculation ECB President Jean-Claude Trichet may indicate this week a readiness to increase borrowing costs while Fed Chairman Ben S. Bernanke may signal economic stimulus will continue. Sweden’s krona climbed to a 30-month high after Riksbank Governor Stefan Ingves said interest rates may be raised at every meeting this year.

“The big driver for the euro has been short-term interest- rate differentials, which had moved against the dollar,” said Paresh Upadhyaya, head of Americas G-10 currency strategy at Bank of America Corp. in New York. “Since the beginning of the year it’s been pretty much a one-way trend.”

IntercontinentalExchange Inc.’s Dollar Index, which tracks the greenback against six currencies, decreased as much as 0.7 percent to 76.756, the lowest level since Nov. 9, before trading at 76.893 at 5 p.m. in New York, down 0.5 percent. The gauge, which is weighted 57.6 percent on euro movements, fell 1.1 percent in February. Read more…

The Fed is Wrong About Commodity Prices

Author: David Weinstein

I imagine he has to say it, but Bernanke is wrong when he says US monetary policy has nothing to do with international commodity prices. At the height of the Egyptian crisis, which was partly driven by rising food prices, Bernanke couldn’t say, “Oh yea, US policy economic policy is part of the problem in Egypt.” This attitude, however, is both prevalent and respected, and it’s largely wrong.

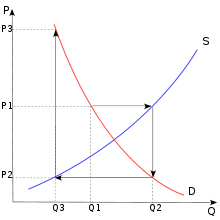

First of all, commodities as a group are not commoditized – they are not all the same. For instance, the amount of gold in the world is largely fixed relative to annual gold production. Along with its historical position as a store a value, Gold’s consistent volume about ground is a primary reason for its currency-like quality; i.e. almost entirely driven by overall liquidity. Corn production, on the other hand can vary greatly from year to year given the amount of land devoted to it and the weather. Oil is somewhere in the middle because production can vary, but the worlds known reserves are relatively fixed. The resulting differences in price volatility have been studied ad nauseam and are most simply articulated by the so-called ‘cob-web model’ (see chart below).

Very simply put: Read more…

Even Donald Trump Is Warning That An Economic Collapse Is Coming

In a shocking new interview, Donald Trump has gone farther than he ever has before in discussing a potential economic collapse in America. Using phrases such as “you’re going to pay $25 for a loaf of bread pretty soon” and “we could end up being another Egypt”, Trump explained to Newsmax that he is incredibly concerned about the direction our economy is headed. Whatever you may think of Donald Trump on a personal level, it is undeniable that he has been extremely successful in business. As one of the most prominent businessmen in America, he is absolutely horrified about what is happening to this nation. In fact, he is so disturbed about the direction that this country is heading that he is seriously considering running for president in 2012. But whether he decides to run in 2012 or not, what Trump is now saying about the U.S. economy should be a huge wake up call for all of us.

In a shocking new interview, Donald Trump has gone farther than he ever has before in discussing a potential economic collapse in America. Using phrases such as “you’re going to pay $25 for a loaf of bread pretty soon” and “we could end up being another Egypt”, Trump explained to Newsmax that he is incredibly concerned about the direction our economy is headed. Whatever you may think of Donald Trump on a personal level, it is undeniable that he has been extremely successful in business. As one of the most prominent businessmen in America, he is absolutely horrified about what is happening to this nation. In fact, he is so disturbed about the direction that this country is heading that he is seriously considering running for president in 2012. But whether he decides to run in 2012 or not, what Trump is now saying about the U.S. economy should be a huge wake up call for all of us.

Trump says that the U.S. government is broke, that all of our jobs are being shipped overseas, that other nations are heavily taking advantage of us and that the value of the U.S. dollar is being destroyed. The following interview with Trump was originally posted on Newsmax and it is really worth watching….

Now, you may or may not think much of Donald Trump as a politician, but when a businessman of his caliber starts using apocalyptic language to describe where the U.S. economy is headed perhaps we should all pay attention.

The following are 12 key quotes that were pulled out of Trump’s new interview along with some facts and statistics that show that what Trump is saying is really happening. Read more…

QE2 Reality Check

The Federal Open Market Committee (FOMC) announced on November 3, 2010 that it would purchase longer-term Treasury securities at a pace of $75 billion dollars per month through the Federal Reserve’s Permanent Open Market Operations (POMO) facility by the end of the second quarter 2011 and potentially beyond. The Quantitative Easing Two (“QE2”) program, championed by Ben Bernanke, chairman of the U.S. Federal Reserve, is expected to total at least $600 billion — and may well total more, if Bernanke and the FOMC deem it to be necessary.

Currently, QE2 is expected to continue until the end of 2011, i.e. up to $1.2 trillion, although there is ongoing policy debate within the Federal Reserve amidst growing fears that the policy may backfire.

Chart courtesy of Shadow Government Statistics |

Could the U.S. central bank go broke?

Reuters

The U.S. Federal Reserve’s journey to the outer limits of monetary policy is raising concerns about how hard it will be to withdraw trillions of dollars in stimulus from the banking system when the time is right.

The U.S. Federal Reserve’s journey to the outer limits of monetary policy is raising concerns about how hard it will be to withdraw trillions of dollars in stimulus from the banking system when the time is right.

While that day seems distant now, some economists and market analysts have even begun pondering the unthinkable: could the vaunted Fed, the world’s most powerful central bank, become insolvent?

Almost by definition, the answer is no.

As the monetary authority, the central bank is the master of the printing press. It can literally conjure up money at will, and arguably did exactly that when it bought about $2 trillion of mortgage-backed securities and U.S. Treasuries to push down borrowing costs and boost the economy.

The Fed’s unorthodox steps helped it generate record profits in 2010, allowing it to send $78.4 billion to the U.S. Treasury Department. But its swollen balance sheet leaves the central bank unusually exposed to possible credit losses that could create a major headache at a time of increasing political encroachment on the Fed’s independence. Read more…

Treasury Five-Year Notes Advance as Bernanke Predicts Slow Growth in Jobs

Treasury five-year notes had the first back-to-back weekly gains since October as U.S. payrolls grew less than forecast and Federal Reserve Chairman Ben S. Bernanke said the labor market’s recovery will be gradual.

Treasury five-year notes had the first back-to-back weekly gains since October as U.S. payrolls grew less than forecast and Federal Reserve Chairman Ben S. Bernanke said the labor market’s recovery will be gradual.

Yields on the notes touched the lowest level in two weeks yesterday after Labor Department data showed nonfarm payrolls expanded by 103,000 last month, versus a median forecast of 150,000 in a Bloomberg News survey. The Treasury will sell $66 billion in securities next week in the year’s first note and bond auctions.

“The five-year leads the way up, and it leads the way down,” said Brian Edmonds, head of interest-rates at Cantor Fitzgerald LP in New York, one of central bank’s 18 primary dealers. “The Fed chairman is setting expectations back further and making people aware that there aren’t a lot of quick fixes and it’s not going to turn on a dime.”

The yield on the five-year note fell five basis points yesterday, or 0.05 percentage point, to 1.96 percent, from 2.01 percent on Dec. 31, according to BGCantor Market Data. It touched 1.93 percent, the lowest since Dec. 21. The yield hadn’t declined for more than a single week at a time since Oct. 8.

Benchmark 10-year note yields rose three basis points to 3.32 percent, from 3.29 percent at the end of last week. Two- year note yields were little changed at 0.59 percent. Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.