Archive

National Debt $200 Trillion Dollars

Dr. Laurence Kotlikoff economics professor at Boston University, discusses the national debt and unfunded liabilities – Aug. 11, 2010

Using CBO data, Kotlikoff says the real national debt is $202 trillion.

Compare the official deficit numbers for July – $165 billion – with the numbers for all of 2002 – where $165 billion covered the deficit for the entire fiscal year.

—

Excerpt:

The Congressional Budget Office whose Long-Term Budget Outlook, released in June, shows an even larger problem.

‘Unofficial’ Liabilities

Based on the CBO’s data, I calculate a fiscal gap of $202 trillion, which is more than 15 times the official debt. This gargantuan discrepancy between our “official” debt and our actual net indebtedness isn’t surprising. It reflects what economists call the labeling problem. Congress has been very careful over the years to label most of its liabilities “unofficial” to keep them off the books and far in the future.

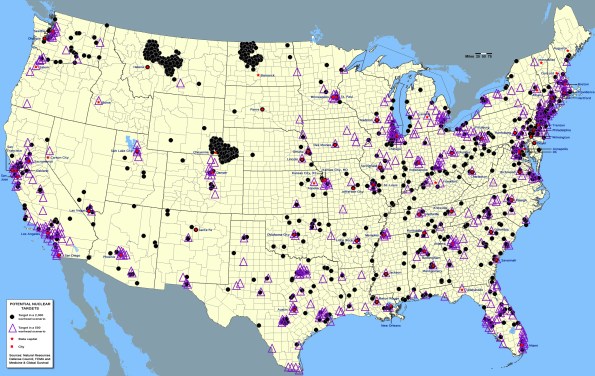

Nuclear Targets in America

In the event of a nuclear war many of these cities have been mapped as potential Nuclear Targets due to being economic centers, tourism, military, local governments Eco hubs etc.. Click on the map to see your town enlarged. Hard to believe is it not? The town that I reside in is not that large in size however it is marked.

This information and other valuable information regarding the “Safeness” of America can be found at http://www.standeyo-cart.com/ProductDetails.asp?ProductCode=PPUSA

2010 in Review-Commodities affected by World Events

IN THE STOCK MARKET, IT’S 1937 ALL OVER AGAIN

One of the most worrisome problems in the stock market right now is that we are basically repeating the exact same situation that occurred from 1937 to 1942.

Most Americans think we’ve had this amazing stock market recovery since the financial crisis of 2008… and we have to a certain extent.

But we are by no means out of the woods.

In fact, during America’s last real economic collapse, in the 1930s and 1940s, we saw a similar drop and recovery… before the markets crashed all over again.

In fact, the situation is eerily similar.

Look at this chart… it’s one of the scariest I’ve seen in a long time. It shows an overlay of what happened in the stock market in 1937 compared to 2008. In both situations, we saw big crashes, of about the exact same magnitude… then a big recovery, again of about the same size.

Look at this chart… it’s one of the scariest I’ve seen in a long time. It shows an overlay of what happened in the stock market in 1937 compared to 2008. In both situations, we saw big crashes, of about the exact same magnitude… then a big recovery, again of about the same size.

But what will happen next?

Well, if history is any guide, we could well have another big leg down in the stock market. That’s exactly what happened 70 years ago.

And with all of the problems left unresolved in our economy today, it could certainly happen again, especially if the U.S. dollar loses its reserve status.

http://www.stansberryresearch.com/pro/1011PSIENDVD/PPSILC42/PR

Ten Riskiest Places to live In America

Ten Riskiest Places to live In America

NOTE: THESE PAGES HAVE BEEN DRAMATICALLY UPDATED

IN Prudent Places USA — 3rd EDITION

The University of Chicago Press will soon release Mark Monmonier’s new

book, Cartographies of Danger, which looks at how well America maps its natural

and technological hazards as well as social hazards like crime and disease. We

asked Mark to give us a list of the country’s ten most hazardous places. Here is

his top ten (or is that bottom ten?) list:

Hazards of different types affecting areas of varying size are not easily

compared. Even so, the research experience makes it easy to identify ten typical

risky places–areas to which I would be reluctant to move.

Our country has many more hazardous environments: some mapped well,

others poorly or not at all. As “Cartographies of Danger” demonstrates, hazard-

zone maps are a relatively new cartographic product as well as a good indication

of how well we understand hazards and manage risk. In the book I also point out

why a comprehensive atlas of hazards is not yet possible and why place-rating

guides that focus largely on crime present a distorted picture of danger.

Mark Monmonier is a professor of geography at Syracuse University’s

Maxwel School of Citizenship and Public Affairs. He is author of numerous books

on cartography, including How to Lie with Maps (1991, 2nd ed. 1996) and

Drawing the Line: Tales of Maps and Cartocontroversy (1995).

Federal Reserve Banking System Explained

Federal Reserve Banking System Explained

Either America Or China Will Crash In 2011

Andy Xie’s latest sees the liquidity war getting worse in 2011.

America will continue to pump the financial system with liquidity via tax cuts and quantitative easing. China will keep the yuan cheap and avoid clamping down on inflation.

The tense equilibrium can’t last for long, as either sovereign debt or inflation gets too heavy to bear. Whoever lasts longer, wins.

The most likely candidates to trigger the next global crisis are the U.S.’s sovereign debt or China’s inflation. When one goes down first, the other can prolong its economic cycle. China may have won the last race. To win the next one, China must tackle its inflation problem, which is ultimately a political and structural issue, in 2011. If China does, the U.S. will again be the cause for the next global crisis. China will suffer from declining exports but benefit from lower oil prices.

On the other hand, if China has a hard landing, the U.S.’s trade deficit can drop dramatically, maybe by 50 percent, due to lower import prices. It would boost the dollar’s value and bring down the U.S.’s treasury yield. The U.S. can have lower finacing costs and lower expenditures. The combination allows the U.S. to enjoy a period of good growth.

Xie notes that China may have the advantage here. While America has committed to a liquidity hose, Beijing still has the opportunity to crack down on inflation:

China’s inflation problem stems from the country’s rapid monetary growth in the past decade. That is due to the need to finance a vast property sector, which is, in turn, to generate fiscal revenues for local governments to finance their vast expenditure programs. Unless something is done to limit local government expenditure, China’s inflation problem is likely to get out of control…

There are two ways to limit local government expenditure. One is to cut their funding source. Their main revenue sources are land sales, property taxes, and bank loans. The last source is drying up a bit, as banks are saddled with high exposure to the sector already and are trying to decrease it. This change isn’t biting yet because local governments haven’t spent all the money they borrowed before.

China needs America to consume their goods. This is the only way to keep its 1.3 billion people working and prevent protests and cause social instability. America has lost it manufacturing bases. They have only the printing press to print fit currency. America needs cheap imports from China to keep the illusion of high standard of living that they are used too.

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.