Archive

**ALERT*** FAKE Silver Coins/Bars/Ingots ARE on the market in U.S.!

**ALERT** FAKE Silver Coins/Bars/Ingots ARE on the market in U.S.!

I had posted about how Tungsten is up 70% in the last year and inserted a video showing fake gold and a video with David Morgan of Silver-Investor discussing fake gold and silver. Last week during the interview David Morgan did with me, he talked about fake gold and silver possibly being on the market, besides other information about it. He also said in the interview, if there will be any fake silver coins they will fake the old coins and not new ones. WOW – he got that one exactly right!

Gold has been a given in regards to possibly being fake due to the price of it! It is well worth an organization (ie: Fed, govt) to fake besides the price, they are pretending there is much more gold than there really is.

With silver, the cost of faking it compared to the cost of the metal itself has Read more…

Rate this:

Lindsey Williams Exclusive: Nwo to Target Iran & Saudi Arabi Next, Oil to Hit $200 a Barrel

Lindsey Williams has been extremely accurate over the past three years when he predicted oil would reach $150 a barrel in 2008, and then six months later, was correct in saying the oil cartels would take the price down to $35. Both of these revelations were deadly accurate, and today, he has perhaps the most important piece of information that he has received from his contacts in the oil industry. The new information Pastor Williams plans to report on today has to do with the intentional crashing of the dollar, Middle East crisis, exploding energy prices, and the want for all-out chaos by those in power. I highly recommend that you listen to the interview as it explains much of what is to come.

Rate this:

Silver To $52-$56 By May-June A Fractal Analysis Suggests

By: Goldrunner (with Lorimer Wilson)

Dollar Inflation remains the driver of the pricing environment for almost everything denominated in U.S. Dollars as long as the Fed continues to monetize debt. The debt monetization creates Dollar Inflation that results in Dollar Devaluation. As the Fed ramps up the QE II that they have announced will end in June, I expect Gold, Silver, and the PM stocks to aggressively rise.

In previous articles I have shown that fractal analysis suggests that:

- · Gold could reach $1860 into the May/ June period based on the late 70’s Fractal. I have also shown the potential for Gold to rise even higher if the market psychology is volatile enough – up to $1975, or even up to $ 2250.

- · The HUI at from HUI 940 to 970 by mid-June is a distinct possibility and we will discuss the fractal considerations for the PM stock indices further in the next editorial.

- · Silver could reach $52 – $56 into May – June of 2011 as explained in Read more…

Rate this:

3 Ways to Prepare for Inflation

In case you haven’t heard,inflation is on its way. Unprecedented levels of government debt and deficits will likely weaken the value of the dollar at some point, thus raising the prices of everything it buys.

In case you haven’t heard,inflation is on its way. Unprecedented levels of government debt and deficits will likely weaken the value of the dollar at some point, thus raising the prices of everything it buys.

But, the Federal Reserve says there’s no significant inflation yet. In fact, it recently said there might be too little inflation and will likely keep interest rates low for the foreseeable future, further increasing the money supply. Meanwhile, commodity prices are going through the roof.

The price of copper has more than tripled since the end of 2008, oil is near $90 a barrel (also near the high since the financial crisis) and prices of several food commodities like corn and wheat are near all time highs. These materials are in turn used to make many consumer goods. It’s only a matter of time before higher input prices come out the other end in the form of higher prices for consumer goods.

In fact, inflation has started to Read more…

Rate this:

Silver Reaches New 30-Year High!

Silver reached a new 30-year high today of $32.87 per ounce up 89% since NIA declared silver the best investment for the next decade on December 11th of 2009 at $17.40 per ounce!

Silver reached a new 30-year high today of $32.87 per ounce up 89% since NIA declared silver the best investment for the next decade on December 11th of 2009 at $17.40 per ounce!

The gold/silver ratio is now down to below 43. NIA predicted a sharp decline in the gold/silver ratio both in its top 10 predictions for 2010 at 64 and in its top 10 predictions for 2011 at 46. We believe the gold/silver ratio will decline to at least 16 within the next few years, but it could decline to as low as 10. It wouldn’t surprise us to see gold reach $5,000 per ounce in 2015 and silver reach $500 per ounce at the same time!

NIA’s President Gerard Adams publicly exposed JP Morgan’s silver naked short selling price suppression scheme in Read more…

Rate this:

Gold Climbs, Silver Touches 30-Year High Amid Inflation Concern

Gold rose to a one-month high as rising consumer prices boosted investor demand for an inflation hedge. Silver touched a 30-year high.

The cost of living in the U.S. climbed in January for a seventh month, the government said today. The U.K. consumer- price index rose to a 26-month high last month, a report this week showed. The precious metal has fallen 2.6 percent this year after rallying 30 percent in 2010 and touching a record in December.

“Gold is ready to resume its uptrend because of the worsening outlook for inflation,” said James Turk, founder of GoldMoney.com, which held $1.4 billion of precious metals and currencies for investors at the end of January.

Gold futures for April delivery climbed $10, or 0.7 percent, to $1,375.10 an ounce at 1:42 p.m. on the Comex in New York. Earlier, the price touched $1,385.40, the highest since Read more…

Rate this:

The Fed is Wrong About Commodity Prices

Author: David Weinstein

I imagine he has to say it, but Bernanke is wrong when he says US monetary policy has nothing to do with international commodity prices. At the height of the Egyptian crisis, which was partly driven by rising food prices, Bernanke couldn’t say, “Oh yea, US policy economic policy is part of the problem in Egypt.” This attitude, however, is both prevalent and respected, and it’s largely wrong.

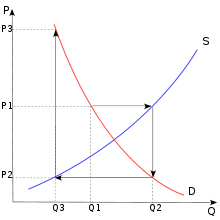

First of all, commodities as a group are not commoditized – they are not all the same. For instance, the amount of gold in the world is largely fixed relative to annual gold production. Along with its historical position as a store a value, Gold’s consistent volume about ground is a primary reason for its currency-like quality; i.e. almost entirely driven by overall liquidity. Corn production, on the other hand can vary greatly from year to year given the amount of land devoted to it and the weather. Oil is somewhere in the middle because production can vary, but the worlds known reserves are relatively fixed. The resulting differences in price volatility have been studied ad nauseam and are most simply articulated by the so-called ‘cob-web model’ (see chart below).

Very simply put: Read more…

Rate this:

China top bank sees explosive growth in gold demand and voracious appetite for silver

SHANGHAI (Reuters) –

Demand in China for physical gold and gold-related investments is growing at an “explosive” pace and its appetite for the yellow metal is poised to remain robust amid inflation concerns, said an Industrial and Commercial Bank of China (ICBC) executive.

Demand in China for physical gold and gold-related investments is growing at an “explosive” pace and its appetite for the yellow metal is poised to remain robust amid inflation concerns, said an Industrial and Commercial Bank of China (ICBC) executive.

ICBC, the world’s largest bank by market value, sold about 7 tonnes of physical gold in January this year, nearly half the 15 tonnes of bullion sold in the whole of 2010, said Zhou Ming, deputy head of the bank’s precious metals department on Wednesday.

“We are seeing explosive demand for gold. As Chinese get wealthy, they look to diversify their investments and gold stands out as a good hedge against inflation,” Zhou told Reuters.

“There is also frantic demand for non-physical gold investments. We issued 1 billion yuan worth of Read more…

Rate this:

Confiscation of Gold and Silver by the U.S. Government

I received an email with the words “RED ALERT”. I received this from someone heavily involved and an expert in the metals and mining. I highly respect both men involved, as they know and always telling the truth about what is happening in the world of metals.

David Morgan of Silver-Investor, an absolute expert in silver and the mining field and has a wonderful and very insightful news letter. I am a member and get the newsletter due to the amount of his knowledge of silver/gold and mining. In fact, David Morgan has given me the green light to post bits of information from his paid subscription newsletter. I am thankful he is allowing that, as there is information in it that is not found any where else on the internet. His newsletter gives investment information of metals and mining as no other person I have read. I believe many benefit from the newsletter and I hope what small blurbs I reproduce here will also help others in keeping the value of their money as it is (but it is dropping fast every day – so action needs to be taken by all – in my opinion). I will start doing some postings with his insight within days. But I encourage Read more…

David Morgan of Silver-Investor, an absolute expert in silver and the mining field and has a wonderful and very insightful news letter. I am a member and get the newsletter due to the amount of his knowledge of silver/gold and mining. In fact, David Morgan has given me the green light to post bits of information from his paid subscription newsletter. I am thankful he is allowing that, as there is information in it that is not found any where else on the internet. His newsletter gives investment information of metals and mining as no other person I have read. I believe many benefit from the newsletter and I hope what small blurbs I reproduce here will also help others in keeping the value of their money as it is (but it is dropping fast every day – so action needs to be taken by all – in my opinion). I will start doing some postings with his insight within days. But I encourage Read more…

Rate this:

Gold-Silver Ratio: Silver value highest in five years

NEW YORK (Commodity Online): As precious metals continue to lead the commodities boom globally, the most frequently asked question these days is where does the gold-silver ratio stand.

NEW YORK (Commodity Online): As precious metals continue to lead the commodities boom globally, the most frequently asked question these days is where does the gold-silver ratio stand.

Over the years, gold has been the high value beneficiary commodity in comparison to silver. But last week, the gold to silver ratio fell to just above 45:1. According to Wayne Atwell, Managing Director of Casimir Capital, the silver value in comparison to gold is the highest in the last five years.

“This is because people—investors—are regarding silver as a safe haven investment just like gold,” he says.

Atwell said: “Suddenly with the anxiety level that’s surfaced about sovereign debt and municipal deficits, people are turning to alternative ways to hedge themselves and I think people felt silver was cheap based on where it has been historically, so they jumped on the bandwagon.”

Gold-Silver ratio is the most important barometer for commodities traders and futures market dealers. Even though Read more…

Rate this:

US Debt

Archives

| S | M | T | W | T | F | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

Translate

Recent Posts

- The Last, Great Run For The U.S. Dollar, The Death Of The Euro And 74 Trillion In Currency Derivatives At Risk

- Are you ‘over-connected’?

- Earth-directed solar X-flare March 11

- Rate Of Climate Change To Soar By 2020s, With Arctic Warming 1°F Per Decade

- American Millennials Are Some Of The World’s Least Skilled People, Study Finds

- Russia and North Korea forge ‘year of friendship’ pariah alliance

Archives

- March 2015

- February 2015

- December 2014

- November 2014

- September 2014

- December 2013

- November 2013

- October 2013

- August 2013

- March 2013

- February 2013

- January 2013

- December 2012

- September 2012

- August 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

Top Posts & Pages

Links

Blog Stats

- 1,390,043 hits

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.