Archive

Empty Store Shelves Coming to America

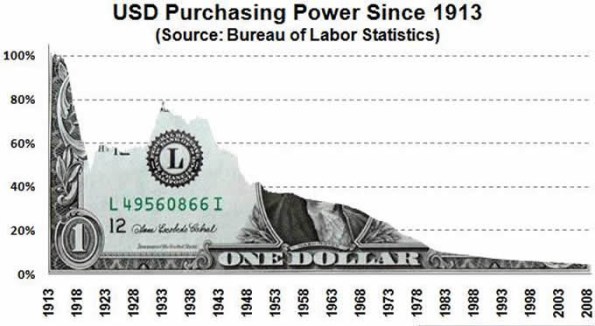

The National Inflation Association today issued a warning to all Americans that empty store shelves will likely be coming to America as a result of government price controls during the upcoming hyperinflationary crisis. This morning, NIA released a video preview of what hyperinflation will look like in the U.S. This extremely important must see video is now available on NIA’s video page.

The National Inflation Association today issued a warning to all Americans that empty store shelves will likely be coming to America as a result of government price controls during the upcoming hyperinflationary crisis. This morning, NIA released a video preview of what hyperinflation will look like in the U.S. This extremely important must see video is now available on NIA’s video page.

NIA’s six-minute video released today goes into detail about an event that took place just outside of Boston, Massachusetts in May of this year. This story was widely ignored by the nationwide mainstream media, but NIA believes it was one of the most important news events of the first half of 2010. Although this particular crisis in Boston was due to decaying infrastructure, NIA believes a currency crisis will lead to the same type of panic on a nationwide basis.

NIA hopes that this video serves as a wake-up call for Americans to take the necessary steps to prepare for hyperinflation and become educated about the U.S. economy. In Zimbabwe during hyperinflation, Zimbabweans were forced to transact in gold and silver. It’s only a matter of time before the U.S. dollar becomes worthless and the only Americans with wealth will be those who own Read more…

Gold Could Have Seen Its 2011 Low

Gold could have already seen it’s low for the year when it dipped to $1,353/oz Friday, before rebounding after the weaker-than-expected U.S. non-farm payrolls data. “With the U.S. economy recovering slower than expected, and worries over (sovereign debt problems in) the euro-zone back on the front line, it seems that we have seen the year low,” says MKS Finance. Spot gold is at $1,371.20/oz, up $1.40 since Friday’s New York close.

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.