Archive

Bank of America sees Brent oil rallying to $140

I posted a article back in December if oil were to go over $145 in 2011. The bad news is in the forthcomming months it will hit $200 per barrel.

LONDON, April 20 (Reuters) – Bank of America Merrill Lynch (BAC.N: Quote) said it expected Brent crude LCOc1 to hit $140 a barrel in the next three months, before falling later in the year as high prices curb demand.

LONDON, April 20 (Reuters) – Bank of America Merrill Lynch (BAC.N: Quote) said it expected Brent crude LCOc1 to hit $140 a barrel in the next three months, before falling later in the year as high prices curb demand.

Brent crude has traded as high as $127.02 in 2011, the highest since 2008 when prices reached an all-time peak above $147.

Influential banks in commodities are expressing contrasting views on whether the rally will persist.

“The time is not yet ripe for oil demand destruction, and we maintain our view that Brent oil will average $122 a barrel this quarter, with prices Read more…

Gas prices surge toward $4, threaten economic recovery

Gas prices continued to gallop toward $4 a gallon early this week, both in the area and across the state, as prices in Minocqua and Rhinelander hit $3.99 on Tuesday, even as prices for crude oil eased, at least temporarily.

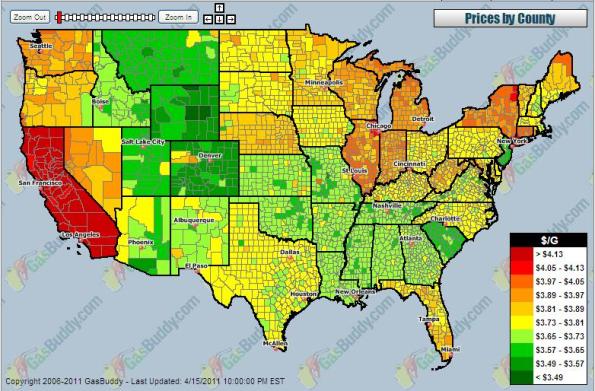

Across the nation, according to GasBuddy.com on Wednesday morning, the national average price for a gallon of regular gasoline stood at $3.79; in Wisconsin, the average was $3.87. Four states, including Illinois, have seen prices already surpass $4.

Crude oil prices moved downward Tuesday from $113 a barrel – the highest price since September 2008 – to $106, a Read more…

UPDATE 2-Oil could hit $200-$300 on Saudi unrest-Yamani

LONDON, April 5 (Reuters) – Oil prices could rocket to $200- $300 a barrel if the world’s top crude exporter Saudi Arabia is hit by serious political unrest, former Saudi oil minister Sheikh Zaki Yamani told Reuters on Tuesday.

Yamani said he saw no immediate sign of further trouble following protests last month calling for political reforms but said that underlying discontent remained unresolved.

“If something happens in Saudi Arabia it will go to $200 to $300. I don’t expect this for the time being, but who would have expected Tunisia?” Yamani told Reuters on the sidelines of a conference of the Centre for Global Energy Studies (CGES) which he chairs.

“The political events that took place are there and we don’t expect them to finish. I think there are some surprises on the horizon,” he said in a speech.

Saudi King Abdullah offered $93 billion in handouts in March in an effort to stave off unrest rocking the Arab world.

So far, demonstrations in the Kingdom have been small in scale and police were able to easily disperse a Shi’ite protest in the oil-producing eastern province last month.

But Yamani said that the reluctance of people to participate in popular protests was merely concealing underlying discontent.

“Some people relax about the situation in Saudi Arabia because the Saudi Islamic brand prohibits people to go to the street and to talk,” he said in a speech.

SAUDI TIME BOMB

Oil traded at two-and-a-half-year highs above $121 a barrel LCOc1 on Tuesday. Libya’s rebellion has shut its oil exports, stoking fears of disruptions in other major producers.

‘The West is to be forgotten. We will not give them our oil’ – Gaddafi

This is just the first step in a long line for the US on not receiving any oil that is pumped from any country in the Middle East resulting in third world status. Lindsey Williams mentioned it on the Alex Jones Show almost a month ago.

http://rt.com/news/libya-oil-gaddafi-arab/

Libyan leader Muammar Gaddafi dismissed his Western partners in an exclusive interview to RT, saying he will give all the country’s oil contracts to Russia, China and India.

Libyan leader Muammar Gaddafi dismissed his Western partners in an exclusive interview to RT, saying he will give all the country’s oil contracts to Russia, China and India.

“We do not believe the West any longer, that is why we invite Russian, Chinese and Indian companies to invest in Libya’s oil and construction spheres” Gaddafi told RT in an exclusive interview about how he sees the current situation in Libya and the international reaction to events there.

“He condemned the Western powers, saying Germany was the only country with a chance of doing business with Libyan oil in the future. “We do not trust their firms – they took part in the conspiracy against us.”

The Libyan leader also added that as far as he is concerned, the Arab League has ceased to exist since it stood up against his country.

According to Gaddafi, the recent upheavals in his country were a “minor event” planned by Al Qaeda that will soon end.

Meanwile, Libyan Deputy Foreign Minister Khaled Kaim promised that Libya will honor Read more…

US could tap oil stockpiles as prices rise: Obama

WASHINGTON (AFP) – President Barack Obama on Friday said he had “tee-ed up” moves to tap emergency US oil stockpiles, as Middle East violence pushed up gas prices for hard-hit US consumers.

WASHINGTON (AFP) – President Barack Obama on Friday said he had “tee-ed up” moves to tap emergency US oil stockpiles, as Middle East violence pushed up gas prices for hard-hit US consumers.

Trying to tamp down concern that oil prices will continue to rise on Middle East unrest, Obama said he was willing to make a rare move to open the strategic reserve, but not yet.

“We are going to try to do everything we can” to stabilize the market, Obama said.

“Everybody should know that should the situation demand it, we are prepared to tap the significant stockpile of oil that we have in the strategic petroleum reserve.”

With Americans struggling with Read more…

Details About India and China’s Plans to Stockpile Crude Oil

Energy expert Matt Badiali writes in DailyWealth that plans out of China and India to create strategic oil reserves of their own could put a floor under the price of oil for years to come:

China and India are faced with the same dilemma the U.S. faced in 1973. Neither country has enough petroleum to keep its citizens rolling for long. Both are exposed to a dangerous, economy-killing oil shock. And both are starting to build and fill strategic petroleum reserves of their own. They have no choice but to buy oil like crazy at these levels.

China has about 102 million barrels already in reserve. It plans to add another 168 million barrels of storage starting this year. It will finish its planned 500 million barrel reserve – equal to three months of imports – by 2020. To hit that mark, China will need about Read more…

Oil Should Spike Higher Following Saudi Riots and Nigerian Elections in April

The following special report on oil (LA Blog Only, leverageacademy.com/blog) discusses the oil market, providing reasons to be bullish on the commodity given unrest in the Middle East, Nigerian elections in April, and rising domestic consumption in oil producing countries, including Venezuela, Nigeria, and Iran. According to the article, the rise of oil prices could easily cause the next recession. In 2010, soft commodities outperformed energy, but that will certainly change given the political headwinds abroad and continued monetary easing in the developed world. Therefore, the Bernanke “Put,” combined with political unrest will be to blame for continued sharp price increases in the energy commodity sector.

The following special report on oil (LA Blog Only, leverageacademy.com/blog) discusses the oil market, providing reasons to be bullish on the commodity given unrest in the Middle East, Nigerian elections in April, and rising domestic consumption in oil producing countries, including Venezuela, Nigeria, and Iran. According to the article, the rise of oil prices could easily cause the next recession. In 2010, soft commodities outperformed energy, but that will certainly change given the political headwinds abroad and continued monetary easing in the developed world. Therefore, the Bernanke “Put,” combined with political unrest will be to blame for continued sharp price increases in the energy commodity sector.

Emerging market demand, especially in China, which now consumes nearly 10mm barrels of oil per day, will also be driving the demand side of the equation. Money supply in China was also up 19.7% in 2010, because of the rapid Read more…

The Oil-Food Price Shock

When future historians attempt to trace the origins of the current turmoil in the Middle East, they will find that one of the earliest of the many explosions of rage occurred in Algeria and was triggered by the rising price of food. On January 5, young protesters in Algiers, Oran and other major cities blocked roads, attacked police stations and burned stores in demonstrations against soaring food prices. Other concerns—high unemployment, pervasive corruption, lack of housing—also aroused their ire, but food costs provided the original impulse. As the epicenter of youthful protest moved elsewhere, first to Tunisia and then to Egypt and other countries, the food price issue was subordinated to more explicitly political demands, but it never disappeared. Indeed, the rising cost of food has been a major theme of anti government demonstrations in Jordan, Sudan and Yemen. With the price of most staples still climbing—spurred in part by a parallel surge in oil costs—more such protests are bound to occur.

When future historians attempt to trace the origins of the current turmoil in the Middle East, they will find that one of the earliest of the many explosions of rage occurred in Algeria and was triggered by the rising price of food. On January 5, young protesters in Algiers, Oran and other major cities blocked roads, attacked police stations and burned stores in demonstrations against soaring food prices. Other concerns—high unemployment, pervasive corruption, lack of housing—also aroused their ire, but food costs provided the original impulse. As the epicenter of youthful protest moved elsewhere, first to Tunisia and then to Egypt and other countries, the food price issue was subordinated to more explicitly political demands, but it never disappeared. Indeed, the rising cost of food has been a major theme of anti government demonstrations in Jordan, Sudan and Yemen. With the price of most staples still climbing—spurred in part by a parallel surge in oil costs—more such protests are bound to occur.

Oil will go up ‘ballistically’ if unrest shifts to Saudi Arabia, says Marc Faber

INTERNATIONAL. Marc Faber the Swiss fund manager and Gloom Boom & Doom editor sees oil prices extending their bull run despite the 15% run-up this year alone.

In an optimistic scenario demand for oil will rise as the global recovery takes hold, and in a pessimistic scenario prices still go up if the Middle East unrest spreads and crude production is curtailed. In both cases, he says, you should be long energy and energy related shares.

In an optimistic scenario demand for oil will rise as the global recovery takes hold, and in a pessimistic scenario prices still go up if the Middle East unrest spreads and crude production is curtailed. In both cases, he says, you should be long energy and energy related shares.

Speaking to CNBC today, Faber said: ” I think long term you should be exposed to energy in either scenario….if you are extra bearish and believe that War World III is going to start soon, as I believe, or in an optimistic scenario”.

Addressing the fundamentals of the oil market, Faber said: “What we had over the last couple of years is essentially a reduction in demand from the developed world, the US, Western Europe and Japan, and continued growth in emerging economies.

“So, if you take a very optimistic view of the world, namely a global economic recovery, demand in the Western World will pick up and demand in the Emerging World will continue to rise strongly, so from a very optimistic point of view you should be long oil,” he recommended.

On the flip side, “in a very pessimistic scenario you have to assume that unrest will shift to Saudi Arabia and other countries in the gulf and at that stage the production is curtailed and in that case obviously oil will go up ballistically.”

Brent crude futures could hit US$200 a barrel if political unrest spreads into Saudi Arabia, Societe Generale said on Monday.

Under what the bank called Geopolitical Scenario 3, “unrest spreads to Read more…

Gaddafi Strikes At Oil Refinery, Escalating the War

Libyan government warplanes have struck an oil facility near the rebel-held eastern town of Ras Lanuf during a heavy bombardment aimed at driving out opposition forces trying to topple Libya’s leader Moammar Gadhafi.

The warplanes bombed the As Sidr oil facility Wednesday, causing a fire and sending huge plumes of smoke into the sky. There were no immediate reports of casualties.

Forces loyal to Gadhafi also shelled rebel positions west of Ras Lanuf, forcing the rebels to retreat. The oil port represents the front line of the rebels’ advance out of their stronghold of eastern Libya.

Libyan government forces also were tightening their siege of the western town of Zawiya, the closest rebel-held area to Gadhafi’s power base in the Libyan capital, Tripoli. Residents said Gadhafi loyalists were surrounding rebels holding out in Zawiya’s central square, using snipers and tanks in the assault.

In remarks broadcast on state television Wednesday, Gadhafi called on Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.