Archive

How Close Are We to a Nano-based Surveillance State?

Michael Edwards

Activist Post

In the span of just three years, we have seen drone surveillance become openly operational on American soil.

In the span of just three years, we have seen drone surveillance become openly operational on American soil.

In 2007, Texas reporters first filmed a predator drone test being conducted by the local police department in tandem with Homeland Security. And in 2009, it was revealed that an operation was underway to use predator drones inland over major cities, far from “border control” functions. This year it has been announced that not only will drone operations fly over the Mexican border, but the United States and Canada are partnering to cover 900 miles of the northern border as well.

Now that the precedent has been set to employ drones over non-combat areas, the military is further revealing the technology of miniaturization that they currently have at their disposal. As drone expert, P.W. Singer said, “At this point, it doesn’t really matter if you are against the technology, because it’s coming.” According to Singer, “The miniaturization of drones is where it really gets interesting. You can use these things anywhere, put them anyplace, and the target will never even know they’re Read more…

Population, Food, Oil … Collision?

World population and growth

Factoring the net birth minus death rate in the world each year, the annual increase to world population is about 75 million people. The current world population is about 6,900,000,000, or 6.9 billion.

Annually, we add to the planet the equivalent population of any of the following scenarios,

- New York City (9 of them!)

- Los Angeles (20 of them!)

- Chicago (27 of them!)

- San Francisco (94 of them!)

- Boston (117 of them!)

- Unites States of America (25 percent of the country!)

When you think about it, this is a startling number. And that’s in just one Read more…

The Real Crisis That Will Soon Hit the US

NATO Warns of Food Crisis and More Unrest, Prices Increase 15% in Four Months

The World Food Program’s representative in one of the countries which has seen protests, Yemen, recently stated: ‘There is an obvious link between high food prices and unrest.’

Credit: NATO

The 2008 food crisis was a warning of things to come. More recently, food prices rose by 15% in just the period October 2010 to January 2011, according to the World Bank’s Food Price Watch.

This time, the impacts have been felt more keenly in political and security circles. The President of Read more…

The Fed is Wrong About Commodity Prices

Author: David Weinstein

I imagine he has to say it, but Bernanke is wrong when he says US monetary policy has nothing to do with international commodity prices. At the height of the Egyptian crisis, which was partly driven by rising food prices, Bernanke couldn’t say, “Oh yea, US policy economic policy is part of the problem in Egypt.” This attitude, however, is both prevalent and respected, and it’s largely wrong.

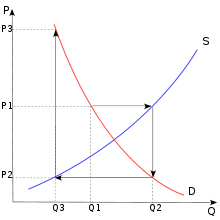

First of all, commodities as a group are not commoditized – they are not all the same. For instance, the amount of gold in the world is largely fixed relative to annual gold production. Along with its historical position as a store a value, Gold’s consistent volume about ground is a primary reason for its currency-like quality; i.e. almost entirely driven by overall liquidity. Corn production, on the other hand can vary greatly from year to year given the amount of land devoted to it and the weather. Oil is somewhere in the middle because production can vary, but the worlds known reserves are relatively fixed. The resulting differences in price volatility have been studied ad nauseam and are most simply articulated by the so-called ‘cob-web model’ (see chart below).

Very simply put: Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.