Archive

Chinese Know Real Value

The International Monetary Fund reported without fanfare recently its projection that the candidate who wins the 2012 U.S. presidential election will be the last U.S. President to lead the world’s richest super power.

The International Monetary Fund reported without fanfare recently its projection that the candidate who wins the 2012 U.S. presidential election will be the last U.S. President to lead the world’s richest super power.

The IMF prediction is based on its calculation that within the next five years China will surpass the United States as the world’s largest economy.

The IMF forecast differs from that of most traditional forecasts, which put the date China’s economy outstrips the U.S. at least a decade or two into the future. However, those traditional forecasters are looking at value as calculated in currency—and as we at WealthCycles.com have reiterated many times, currency lies.

Should You Buy A Home In 2011? Check Out These 29 Absolutely Crazy Statistics About The Housing Crisis

Has the U.S. housing market reached a “bottom” yet? Are home prices going to start recovering? Is the housing crisis going to end at some point? Today there are millions of American families that would like to buy homes but they are not sure what to do. After all, nobody wants to end up like all the suckers that bought at the top of the market and now owe far more on their mortgages then their homes are worth. A lot of people are really afraid to take out home loans right now. So should you buy a home in 2011? That is a very good question. The reality is that there are a lot of reasons why home prices could continue to fall. Unemployment is still rampant, and American families simply cannot afford to buy homes without good jobs. Also, lending institutions have really, really tightened lending standards. That is really restricting the number of buyers in the marketplace. The number of foreclosures Read more…

Has the U.S. housing market reached a “bottom” yet? Are home prices going to start recovering? Is the housing crisis going to end at some point? Today there are millions of American families that would like to buy homes but they are not sure what to do. After all, nobody wants to end up like all the suckers that bought at the top of the market and now owe far more on their mortgages then their homes are worth. A lot of people are really afraid to take out home loans right now. So should you buy a home in 2011? That is a very good question. The reality is that there are a lot of reasons why home prices could continue to fall. Unemployment is still rampant, and American families simply cannot afford to buy homes without good jobs. Also, lending institutions have really, really tightened lending standards. That is really restricting the number of buyers in the marketplace. The number of foreclosures Read more…

IMF bombshell: Age of America nears end: China’s economy will surpass the U.S. in 2016

For the first time, the international organization has set a date for the moment when the “Age of America” will end and the U.S. economy will be overtaken by that of China.

For the first time, the international organization has set a date for the moment when the “Age of America” will end and the U.S. economy will be overtaken by that of China.

The Obama deficit tour

The Wall Street Journal editorial page’s Steve Moore critiques the president’s speeches attacking Republican budget plans.

And it’s a lot closer than you may think.

According to the latest IMF official forecasts, China’s economy will surpass that of America in real terms in 2016 — just five years from now.

Put that in your calendar.

It provides a painful context for the budget wrangling taking place in Washington, D.C., right now. It raises enormous questions about what the international security system is going to look like in just a handful of years. And it casts a deepening cloud over both the U.S. dollar and the giant Treasury market, which have been propped up for decades by their privileged status as the liabilities of the world’s hegemonic power.

According to the IMF forecast, whomever is elected U.S. president next year — Obama? Mitt Romney? Donald Trump? — will be the last to preside over the world’s largest economy.

Most people aren’t prepared for this. They aren’t even aware it’s that close. Listen to experts of various stripes, and they will tell you Read more…

PBOC’s Zhou Urges Cutting China’s $3 Trillion of Foreign-Exchange Reserves

Zhou Xiaochuan, governor of the People’s Bank of China. Photographer: Qilai Shen/Bloomberg

China needs to reduce its foreign- exchange reserves as they exceed the level the nation requires, central bank Governor Zhou Xiaochuan said.

The management and diversification of the holdings, which topped $3 trillion at the end of March, should be improved, Zhou said after a speech at Tsinghua University in Beijing late yesterday. The rapid accumulation is putting pressure on the sterilization operations of the People’s Bank of China, he said.

The nation’s foreign-exchange reserves climbed $197 billion in the first quarter, reflecting global imbalances that Group of 20 finance ministers agreed last week to address through deeper scrutiny of their economic policies. China’s surging holdings are fueling inflation that accelerated last month to the highest in 32 months, prompting the government to boost banks’ reserve requirements this week for the fourth time this year.

“Foreign-exchange reserves have exceeded the reasonable levels that we actually need,” Zhou said. “The rapid increase in reserves may have led to excessive liquidity and has exerted significant sterilization pressure. If the government doesn’t strike the right balance with its policies, the build-up could cause big risks,” he said, without elaborating.

The world’s second-biggest economy grew 9.7 percent in the first quarter from a year earlier, faster than economists had forecast, and consumer prices climbed Read more…

Stocks Sink on U.S. Credit Outlook as Euro Falls on Debt Crises

U.S. stocks sank the most in a month, oil slid and gold rose to a record after Standard & Poor’s cut the American credit outlook to negative and concern about Europe’s debt crisis worsened. Greek two-year bond yields surged to 20 percent for the first time since at least 1998.

U.S. stocks sank the most in a month, oil slid and gold rose to a record after Standard & Poor’s cut the American credit outlook to negative and concern about Europe’s debt crisis worsened. Greek two-year bond yields surged to 20 percent for the first time since at least 1998.

The S&P 500 tumbled 1.6 percent to 1,298.09 at 1:13 p.m. in New York and the Stoxx Europe 600 Index slid 1.7 percent. Ten- year Treasury yields lost three basis points to 3.38 percent as concern about Europe’s finances overshadowed S&P’s move. The euro lost 1.4 percent to $1.4227, while Portuguese debt- insurance costs rose to a record. The S&P GSCI index of 24 commodities slid 1.3 percent as oil and cocoa tumbled.

S&P assigned a one-in-three chance it will lower the U.S. rating in the next two years, saying the credit crisis and recession that began in 2008 worsened a deterioration in public finances. Budget differences among Democrats and Republicans remain wide and it may take until after the 2012 elections to get a proposal that addresses the concern, S&P said.

“This is another indication of the need for the U.S. to better control its fiscal destiny, both for its sake and that of the global economy,” said Mohamed El-Erian, chief executive officer at Newport Beach, California-based Pacific Investment Management Co., the world’s biggest manager of bond funds. “Absent credible medium-term fiscal reform, every segment of U.S. society would be faced with higher borrowing costs, a weaker dollar and a less bright outlook for employment, investment and growth.”

Broad Decline

Commodity, industrial and technology companies had the biggest Read more…

Prepare for the Next Conflict: Water Wars

Every minute, 15 children die from drinking dirty water. Every time you eat a hamburger, you consume 2400 liters of the planet’s fresh water resources — that is the amount of water needed to produce one hamburger. Today poor people are dying from lack of water, while rich people are consuming enormous amounts of water. This water paradox illustrates that we are currently looking at a global water conflict in the making.

Every minute, 15 children die from drinking dirty water. Every time you eat a hamburger, you consume 2400 liters of the planet’s fresh water resources — that is the amount of water needed to produce one hamburger. Today poor people are dying from lack of water, while rich people are consuming enormous amounts of water. This water paradox illustrates that we are currently looking at a global water conflict in the making.

We are terrifyingly fast consuming one of the most important and perishable resources of the planet — our water. Global water use has tripled over the last 50 years. The World Bank reports that 80 countries now have water shortages with more than 2.8 billion people living in areas of high water stress. This is expected to rise to 3.9 billion — more than half of Read more…

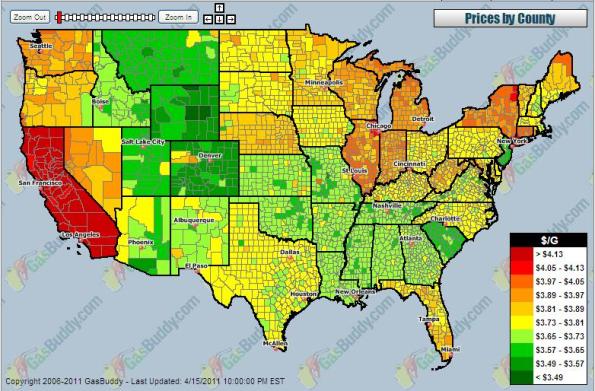

Gas prices surge toward $4, threaten economic recovery

Gas prices continued to gallop toward $4 a gallon early this week, both in the area and across the state, as prices in Minocqua and Rhinelander hit $3.99 on Tuesday, even as prices for crude oil eased, at least temporarily.

Across the nation, according to GasBuddy.com on Wednesday morning, the national average price for a gallon of regular gasoline stood at $3.79; in Wisconsin, the average was $3.87. Four states, including Illinois, have seen prices already surpass $4.

Crude oil prices moved downward Tuesday from $113 a barrel – the highest price since September 2008 – to $106, a Read more…

China-Russia relations and the United States: At a turning point?

Since the end of the Cold War, the improved political and economic relationship between Beijing and Moscow has affected a range of international security issues. China and Russia have expanded their bilateral economic and security cooperation. In addition, they have pursued distinct, yet parallel, policies regarding many global and regional issues.

Yet, Chinese and Russian approaches to a range of significant subjects are still largely uncoordinated and at times in conflict. Economic exchanges between China and Russia remain minimal compared to those found between most friendly countries, let alone allies.

Although stronger Chinese-Russian ties could present greater challenges to other countries (e.g., the establishment of a Moscow-Beijing condominium over Central Asia), several factors make it unlikely that the two countries will form such a bloc.

The relationship between the Chinese and Russian governments is perhaps the best it has ever been. The leaders of both countries engage in numerous high-level exchanges, make many mutually supportive statements, and manifest other displays of Russian-Chinese cooperation in what both governments refer to as their developing strategic partnership.

The current benign situation is due less to common values and shared interests than to the fact that Chinese and Russian security concerns are Read more…

China blocks coastal waters, enlarges military

Pacific’s chief calls shadowy move ‘troubling’

**file photo **Chinese paramilitary police patrol in Urumqi, western China’s Xinjiang province. (AP Photo/Eugene Hoshiko)

NavyAdm. Robert F. Willard said during a hearing of the Senate Armed Services Committee that China’s intentions behind its decades-long buildup remain hidden and are undermining stability in the Asia-Pacific region.

The four-star admiral said the arms buildup is understandable because of China’s economic rise, but “the scope and pace of its modernization without clarity on China’s ultimate goals remains troubling.”

“For example, China continues to accelerate its offensive air and missile developments without corresponding public clarification about how these forces will be utilized,” he said.

Chinese officials, in meetings with their U.S. counterparts, have refused to explain the pace or goal of the arms buildup, defense Read more…

China Inflation Is `Somewhat Out of Control’ on Weak Currency, Soros Says

China’s decision to keep its currency weak has caused the government to lose control of inflation and risks fuelling wage-price gains, billionaire investor George Soros said.

While the policy helped insulate China from the financial crisis in 2008, the world’s second-biggest economy has missed its chance to allow the yuan to appreciate to tame inflation, Soros, chairman of Soros Fund Management LLC, said yesterday at a conference in Bretton Woods, New Hampshire.

“It would be very advantageous to allow the currency to appreciate as a way of controlling inflation,” Soros said. “The authorities missed that opportunity. You now have inflation somewhat out of control, and causing some serious danger of wage-price inflation.”

The yuan gained 4.6 percent against the U.S. dollar in the past two years, the second-smallest gain of 10 Asian currencies tracked by Bloomberg, even as economic growth rebounded and foreign-exchange reserves jumped to a record. Inflation accelerated to Read more…

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](https://i0.wp.com/www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

You must be logged in to post a comment.